CPAs can also represent clients during government audits, while non-certified tax specialists cannot. Also and although it’s not required by every company hiring tax accountants, CPA candidates should complete a master’s program in accounting. From a business perspective, more information must be analyzed as part of the tax accounting process. While the company’s earnings, or incoming funds, must be tracked just as they are for the individual, there is an additional level of complexity regarding any outgoing funds directed towards certain business obligations. This can include funds directed towards specific business expenses as well as funds directed towards shareholders.

What is the difference between a CPA and a tax accountant?

- Throughout the filing process, they keep clients updated on their return information.

- Additionally, I’d say that your career path doesn’t have to be the same as someone else’s and so follow your passions and you can build the career you want.

- You are not alone if you shudder at the notion of preparing your tax return and wonder how to locate a qualified tax accountant.

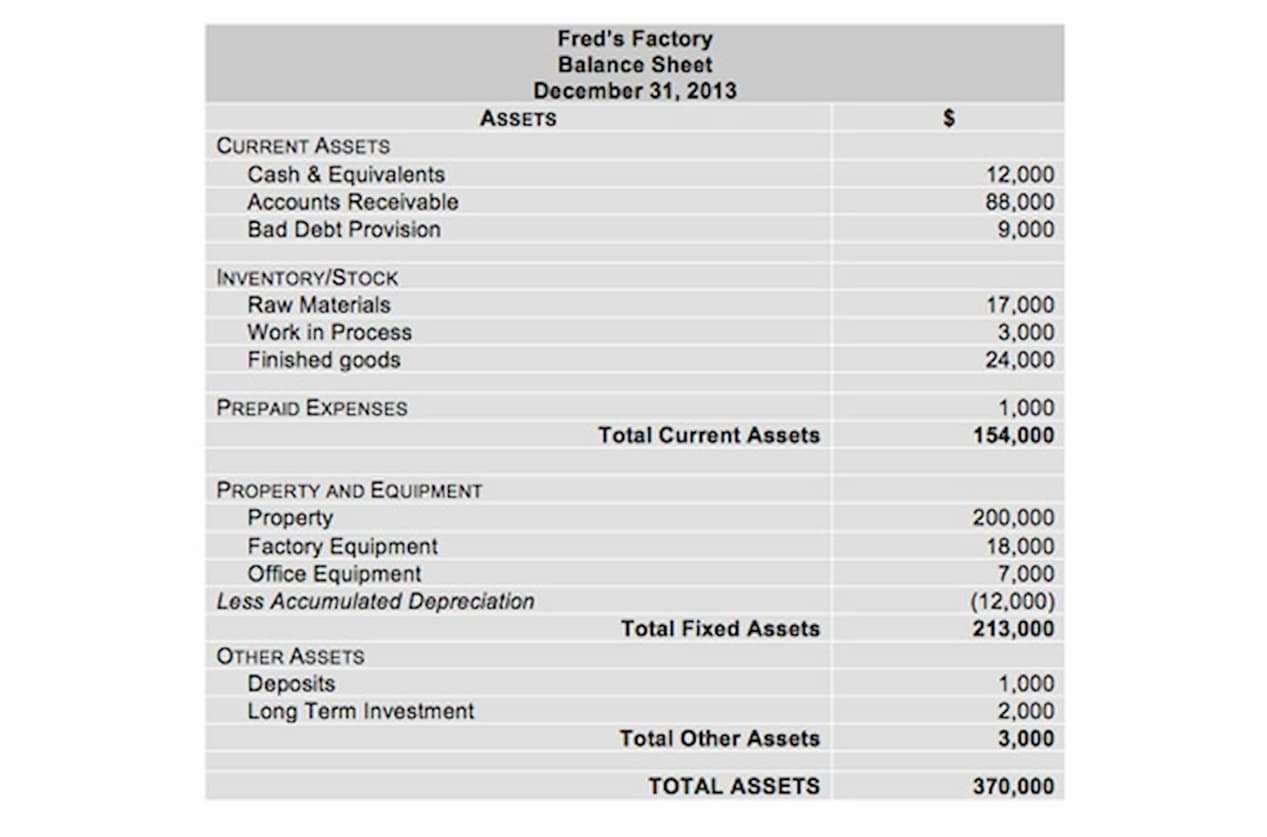

- To determine a company’s taxable income, subtract the COGS from its revenue.

The process focusses on revenue earned, deductions, donations, gain or loss from investment, etc. It is a complex process, even though there may be usage of tax accounting software, where thorough analysis is done regarding when and where the fund is spent and whether it is taxable or not. They hire the expertise of accountants specializing in tax accounting to guarantee adherence to financial and industry norms when managing their finances. One of the most popular types of accountants likely to take advantage of tax accounting methods is CPA (Certified Public Accountant). By maintaining accurate tax accounting records, tax-exempt entities can demonstrate their adherence to the laws and regulations governing their operations.

What are the two main types of financial accounting?

- One mistake could flag someone for an audit, and if they prepared their own taxes, they’ll need to hire someone to help.

- In contrast, tax regimes are generally not similarly focused and often include aspects of tax policy that seek to incentivize certain behaviors.

- By maintaining accurate tax accounting records, tax-exempt entities can demonstrate their adherence to the laws and regulations governing their operations.

- According to transfer pricing policies, the organization must pay a certain percentage (8-15%) of tax on the expenses incurred in managing the offshore office.

It’s probably safe to say that everyone from sole proprietors to large corporations could benefit from hiring a good tax accountant. After all, tax accounting mistakes can cost you a lot of money and get you in trouble with the IRS, which can have serious legal consequences. Tax accountants help individuals, businesses and nonprofit organizations comply with the Internal Revenue Code. They also help their clients develop tax strategies to reduce their taxes as much as legally possible.

Deferred Tax Assets

Its main aim is to comply with legal requirements and optimize tax liabilities. The primary objective of income tax accounting is to determine taxable profits and tax liabilities by making adjustments to book profits derived from accounting principles. These calculations and adjustments constitute a crucial element of tax returns and are online bookkeeping maintained for tax audit purposes.

What Is Tax Accounting?

An accountant is a professional with a bachelor’s degree who provides financial advice, tax planning and bookkeeping services. They perform various business functions such as the preparation of financial reports, payroll and cash management. Accounting is the process of keeping track of all financial transactions within a business, such as any money coming in and money https://www.bookstime.com/ going out. It’s not only important for businesses in terms of record keeping and general business management, but also for legal reasons and tax purposes.

- While degrees aren’t always required, many accountants have a bachelor’s in accounting or finance.

- The primary reason is that most organizations must file annual returns, regardless of their tax-exempt status.

- Most importantly, you can google their name to see what shows up and ensure nothing is buried by scrolling through the first few pages of search results.

- They can even act as financial advisors, and sometimes are hired to do so when dealing with large sums of money and assets.

- These returns entail providing detailed information about incoming funds, such as grants or donations, and outlining how these funds have been utilized during the organization’s operations.

Tax accounting remains a crucial aspect of their financial management, even for tax-exempt organizations. The primary reason is that most organizations must file annual returns, regardless of their tax-exempt status. These returns entail providing detailed information about incoming funds, such as grants or donations, and outlining how these funds have been utilized during the organization’s operations. Tax accounting is a set of methods for accounting and a useful tool that companies use to understand their tax liability and avoid penalties. Tax accounting is key not only for businesses but also for individuals to declare the correct income, accounting definition in business pay appropriate taxes, and avoid penalties or IRS audits.