Yardi® develops and supports industry-leading investment and property management software for all types and sizes of real estate companies. Established in 1984, Yardi is based in Santa Barbara, Calif., and serves clients worldwide. For more information on how Yardi is Energized for Tomorrow, visit Yardi.com. Allow residents to pay rent, submit maintenance requests, renew leases and more through a secure resident portal or mobile app that integrates seamlessly with Yardi Breeze. Voyager is a comprehensive system for real estate operators with unique and dynamic requirements. View Yardi’s asset definition and meaning COVID-19 support resources to see what else Yardi is doing to support theindustry during the pandemic.

Property Management

Choosing the right property management software to organize, optimize and grow your business is a big decision, but it shouldn’t be overwhelming. Use the property management software checklist to help you make the right decision when reviewing the solutions available to you from any real estate technology provider. Breeze is a refreshingly simple property management system that works for residential, commercial, affordable housing, manufactured housing, self storage and associations. You can get started using Breeze in just a day, no advanced training or experience required.

Features:

It has everything you could ever need to run your property…I think this software is a game changer. Yardi Breeze’s intuitive design and modern, user-friendly interface make it easy to complete tasks from anywhere. Automatic reporting has turned minutes of work into the click of a button. We’re probably saving 15 to 20 hours a week with Breeze Premier.

- Our award-winning energy management systems reduce HVAC costs and ensure regulatory compliance without reducing comfort.

- Breeze is a refreshingly simple property management system that works for residential, commercial, affordable housing, manufactured housing, self storage and associations.

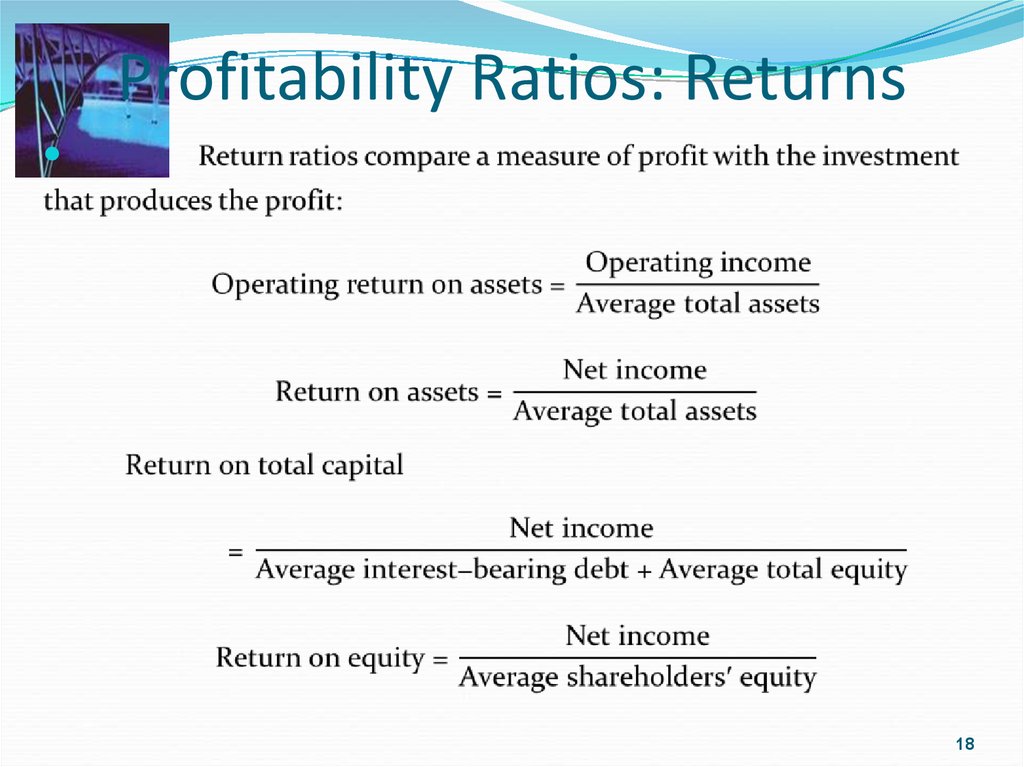

- By connecting business intelligence at the investment, operations and financial levels, our platforms drive value for funds holding real estate assets.

- Automatic reporting has turned minutes of work into the click of a button.

- The best property management software maximizes efficiency, convenience and ROI for property managers, occupants and investors.

- You can get started using Breeze in just a day, no advanced training or experience required.

Find out which property management software is right for you

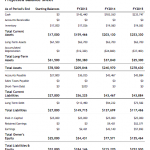

We can operate like an A+ property but still give that smaller hometown service. Yardi Breeze Premier is intuitive and easy to use.We love the built-in accounting. Track costs including budgets, contracts, payments and retention. Manage your contacts, commitments and cash flow to stay on budget. Deliver customized financials and offer property performance comparisons within an owner’s portfolio. Centralize and manage contacts, track investor activity and improve collaboration.

About Yardi BreezeYardi® Breeze is the refreshingly simple propertymanagement software platform by leading real estate technology provider,Yardi®. It puts you in charge of marketing, leasing and managing your entireportfolio, with support for residential, commercial, affordable, self storage,HOA/condo and manufactured properties. Day-to-day operations are intimately tied to asset value and investment performance. Our solutions help attract and retain occupants with advanced marketing and online services, for example.

Being able to generate financial reports is a lot smoother with Breeze Premier and saves a lot of time. Be confident that your numbers will always add up with our industry standard, built-in payables, receivables and general ledger functions. Yardi Breeze has a simple, affordable pricing model with monthly fees starting at $1 per unit. Engage prospects with a customized, mobile-friendly website built to help you appear in search results. The biggest impact I’ve seen from moving our business to Yardi Breeze is in the level of service we’ve been able to provide to our customers.

Managers can be up and running on Yardi Breeze in minutes with its streamlined set-up and on-boarding tasks. And, its built-in live chat support feature allows users to get answers to questions quickly from dedicated Yardi Breeze support experts. It is very user-friendly, and the ability to live chat with the support staff is fantastic. They are readily available to assist and answer any question you may have.

Cut down on data entry mistakes and increase transparency when your team works from a single source of truth. Contact our support team via the built-in live chat function, simplifying the process and finding the right answers faster. Cut down on data entry mistakes and increase transparency when your teams works from a single source of truth. Maintaining multiple systems can be expensive, time-consuming and error-prone — making it hard to access and analyze your data. We seamlessly integrate asset management, facility operations, forecasting, financials, construction and leasing in one system.