However, sales of assets such as land, building, and furniture are not recorded in the sales journal because they are sold infrequently. The sales journal concept is mostly confined to manual accounting systems; it is not always used in computerized accounting systems, where there is less need for subsidiary-level journals. For locations with sales taxes, you also need to record the sales tax that your customer paid so you know how much to pay the government later. You also have to make a record of your inventory moving and the sales tax. When you credit the revenue account, it means that your total revenue has increased. This is because of the fact that sales are basically an income-generating operation, so sales are entered in the credit side of the sales journal.

So, whether sales are credit or debit depends upon whether sales are made or products are returned. Each sale invoice is recorded as a line item in the sales journal as shown in the example below. In this example some information has been omitted to simplify the example. In practice, each line item would include the information listed above. If your sales returns and allowances account is high compared to your revenue account, you may be offering too many discounts or have a product quality issue.

This way, you can balance your books and report your income accurately. This is done to avoid the chances of fraud to avoid any unnecessary losses. This is all now done by software, where a person types the invoice number into the account and the software tracks down the sale. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Finally, at the end of the month, the accounts receivable trial balance is prepared. Postings to the subsidiary ledger should be made daily to ensure that management has up-to-date knowledge about how much each customer owes.

Post navigation

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

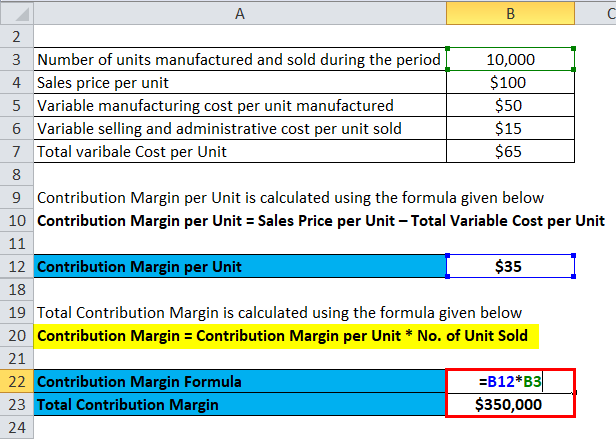

The sale type columns will depend on the nature of business. Some businesses simply have one column to record the sales amount whereas others need additional columns for sales tax, delivery fees charged to customers etc. The multi-column journal should always have an ‘other’ column to record amounts which do not fit into any of the main categories. You’ll record a total revenue credit of $50 to represent the full price of the shirt.

Cash Flow Statement

11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. An allowance is a price reduction on an item, often because of a sale or a flawed item like a floor display model with a dent.

Sales Journal FAQs

Little Electrodes, Inc. is a retailer that sells electronics and computer parts. On January 1, Little Electrode, Inc. sells a computer monitor to a customer for $1,000. Little Electrode, Inc. purchased this monitor from the manufacturer for $750 three months ago. Here’s how Little Electrode, Inc. would record this sales journal entry. If you have accounting software or a bookkeeper, you may not be making these entries yourself.

It also is not necessary to write an explanation of the transaction because only credit sales are recorded.Finally, the amount of time needed to post entries is reduced. Although each transaction must be posted to the subsidiary Accounts Receivable ledger, only the totals for the month have to be posted to the General Ledger accounts. A Sales Journal, also known as the Sales Day Book, is a specialized accounting journal used to record all credit sales of merchandise.

Example of the Sales Journal Entry

Cash payment journals record the cash payments made by the clients of a company. Sales journals record sales and some other particular metrics related to sales. Account receivables are mentioned when the client purchases a product or service on credit, and sales are mentioned when the client purchases a product or service and pays for it through cash. Now, there is software that automatically enters the former managers allege pervasive inventory fraud at walmart how deep does the rot go day, time, and even the name of the goods sold. This software also allows the inventory to be automatically updated when a specific good is running low on inventory, by automatically ordering that particular good from the supplier. The sales journal, sometimes called the credit sales journal, is used to record all sales made on account.

Had the sales journal recorded other items such sales tax, delivery fees charged to customers etc, then the credit would have gone to the appropriate tax or income account. On business drivers a regular (usually daily) basis, the line items in the sales journal are used to update each customer account in the accounts receivable ledger. In the above example, 400 is posted to the ledger account of customer BCD, 150 to customer KLM, and 350 to customer PQR.

- Sales journals record sales and some other particular metrics related to sales.

- Instead, you collect sales tax at the time of purchase, and you make payments to the government quarterly or monthly, depending on your state and local rules.

- All of the cash sales of inventory are recorded in the cash receipts journal and all non-inventory sales are recorded in the general journal.

- Notice that only credit sales of inventory and merchandise items are recorded in the sales journal.

- Debits and credits work differently based on what type of account they are.

After the posting, the account number or a check is placed in the post reference (Post Ref.) column. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries.

All of the cash sales of inventory are recorded in the cash receipts journal and all non-inventory sales are recorded in the general journal. A sales journal is a subsidiary ledger used to store detailed sales transactions. Its main purpose is to remove a source of high-volume transactions from the general ledger, thereby streamlining it. The transaction number, account number, customer name, invoice number, and sales amount are typically stored in the sales journal for each sale transaction. When a transaction is recorded, the accounts receivable account is debited, while the sales account is credited. Using a sales journal significantly decreases the amount of work needed to record transactions in a manual system.

However, the debit to the sales returns and allowances account ultimately subtracts $10 from your revenue, showing that you actually only earned $40 for the shirt. To record a returned item, you’ll use the sales returns and allowances account. This account is for deductions from revenue that result from returns or allowances. This means that when you debit the sales returns and allowances account, that amount gets subtracted from your gross revenue. Each client is given a certain number and the same number, post reference is different from the account debited, as this does not contain the amount of money for a particular order from the client.