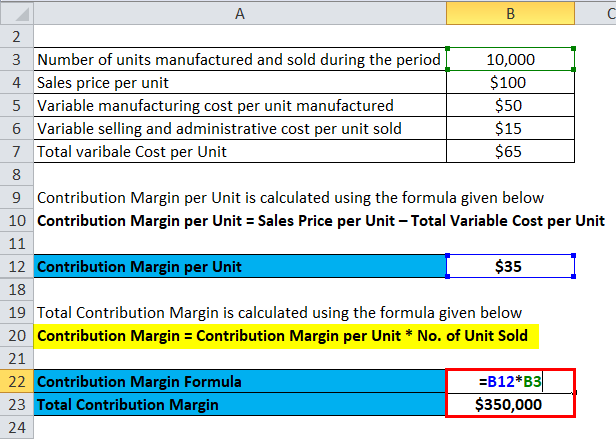

The contribution margin can help company management select from among several possible products that compete to use the same set of manufacturing resources. Say that a company has a pen-manufacturing machine that is capable of producing both ink pens and ball-point pens, and management must make a choice to produce only one of them. Where C is the contribution margin, R is the total revenue, and V represents variable costs. The contribution margin can be stated on a gross or per-unit basis. It represents the incremental money generated for each product/unit sold after deducting the variable portion of the firm’s costs.

What Is the Formula For the Contribution Margin?

Thus, the concept of contribution margin is used to determine the minimum price at which you should sell your goods or services to cover its costs. Therefore, it is not advised to continue selling your product if your contribution margin ratio is too low or negative. This is because it would be quite challenging for your business to earn profits over the long-term. The contribution margin ratio is also known as the profit volume ratio.

Business Class

It could also help you figure out how to structure sales commissions. To calculate contribution margin (CM) by product, calculate it for each product on a per-unit basis. After you’ve completed the unit contribution margin calculation, you can also determine the contribution margin by product in total dollars. The addition of $1 per item of variable cost lowered the contribution margin ratio by a whopping 10%.

Sales Revenue

- While contribution margin is expressed in a dollar amount, the contribution margin ratio is the value of a company’s sales minus its variable costs, expressed as a percentage of sales.

- Typical variable costs include direct material costs, production labor costs, shipping supplies, and sales commissions.

- In the Dobson Books Company example, the contribution margin for selling $200,000 worth of books was $120,000.

- The contribution margin is the foundation for break-even analysis used in the overall cost and sales price planning for products.

Management must be careful and analyze why CM is low before making any decisions about closing an unprofitable department or discontinuing a product, as things could change in the near future. However, when CM is expressed as a ratio or as a percentage of sales, it provides a sound alternative to the profit ratio. Now, divide the total contribution margin by the number of units sold. Instead of doing contribution margin analyses on whole product lines, it is also helpful to find out just how much every unit sold is bringing into the business. In this example, if we had been given the fixed expenses, we could also find out the firm’s net profit.

Calculating the Contribution Margin and Ratio

This resulting margin indicates the amount of money available with your business to pay for its fixed expenses and earn profit. The difference between fixed and variable costs has to do with their correlation to the production levels of a company. As we said earlier, variable costs have a direct relationship with production levels. As production levels increase, so do variable costs and vise versa. Fixed costs stay the same no matter what the level of production. Variable costs are not typically reported on general purpose financial statements as a separate category.

Accordingly, in the Dobson Books Company example, the contribution margin ratio was as follows. This is because the contribution margin ratio lets you know the proportion of profit that your business generates at a given level of output. Sales revenue refers tax bracket definition to the total income your business generates as a result of selling goods or services. Furthermore, sales revenue can be categorized into gross and net sales revenue. Fixed costs are the costs that do not change with the change in the level of output.

Management accountants identify financial statement costs and expenses into variable and fixed classifications. Variable costs vary with the volume of activity, such as the number of units of a product produced in a manufacturing company. The contribution margin ratio is just one of many important financial metrics used for making better informed business decisions. The ratio can help businesses choose a pricing strategy that makes sure sales cover variable costs, with enough left over to contribute to both fixed expenses and profits.

For a quick example to illustrate the concept, suppose there is an e-commerce retailer selling t-shirts online for $25.00 with variable costs of $10.00 per unit. In particular, the use-case of the contribution margin is most practical for companies in setting prices on their products and services appropriately to optimize their revenue growth and profitability potential. The contribution margin (CM) is the profit generated once variable costs have been deducted from revenue. In May, \(750\) of the Blue Jay models were sold as shown on the contribution margin income statement. When comparing the two statements, take note of what changed and what remained the same from April to May. However, they will play an important part in calculating the net income formula.

Fixed costs stay the same regardless of the number of units sold, while variable costs change per unit sold. Now, this situation can change when your level of production increases. As mentioned above, the per unit variable cost decreases with the increase in the level of production. Furthermore, the variable costs can be either direct or indirect. Direct Costs are the costs that can be directly identified or allocated to your products.