Certificate Program in Accounting

The agency projects a 7% job growth rate between 2020 and 2030. Learn more about Academic what is sage50 Partnerships. Credits earned in this program may be transferred toward an Associate in Applied Science Degree in Accounting, provided the student meets the entrance requirements for the Accounting program. I especially like the CFO Dashboard; it’s easy to customize and gives you an overview of all your major metrics. Your expenses are categorized automatically, so you will know what to deduct on your taxes when you are ready to file. Free accounting software options like Wave Accounting and Zoho Books which has a free plan for businesses that make less than $50K USD in revenue per year remove the hassle of by hand financial data entry without subtracting cash from your bottom line. Take the next step toward earning your online certificate in accounting at Davenport. Sage 50cloud is a robust online accounting software platform that incorporates comprehensive customization options with in depth financial tools.

Request more Information

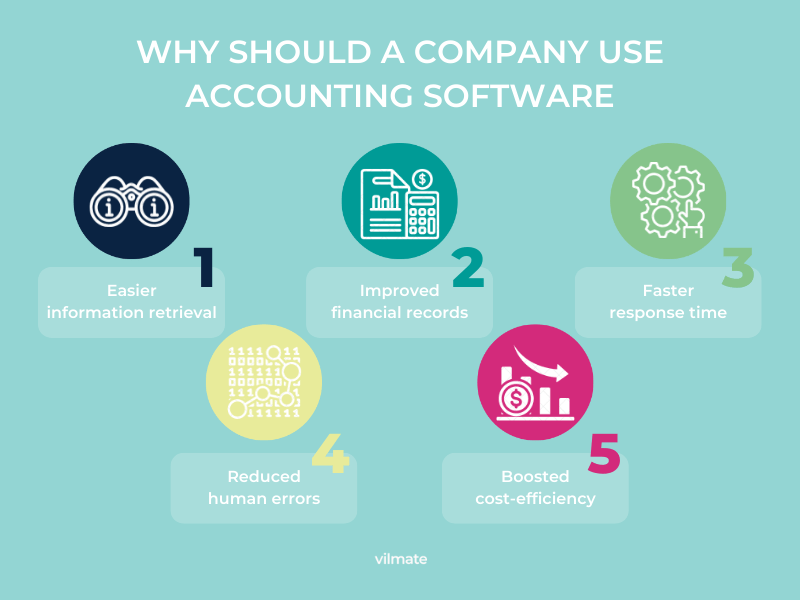

Send professional invoices in seconds, get paid seamlessly with all major credit cards or PayPal, and set and forget it with auto billing and automated payment reminders. You need good records to prepare your tax returns. NewLaw: Optimising your legal function. The only exception to this rule includes. It handles invoicing and credit notes, accounts payable and receivable, employee expenses and some payroll features too, and it’s quite happy with multiple currencies, cards and accounts. A maximum of one course from the “other” list may be applied towards the major requirements. The six required courses in the curriculum can be completed online each week as your schedule allows. It’s the best accounting platform for a small company that’s just starting out and has few expenses to spare. Wave is a PCI DSS Level 1 Service Provider. Why should I use accounting software for my business. Please refer to the CPA Ontario Approved Pre requisite Courses for Entry into the CPA PEP for more information. “Everything I need in one easy to use platform. A $50 application fee. However, note that while Wave has plenty of free offerings, you still pay per transaction. Students in the program gain valuable business knowledge and strengthen transferable skills. At the time of writing, this fee is at 2.

The Top Accounting Certificate Programs

For example, you won’t find comprehensive details on cash flow or sales trends. University of Notre Dame, through its Mendoza College of Business, offers a top ranked Bachelor of Accountancy program that helps students build the theoretical and foundational knowledge to succeed in the field of accounting. It syncs with your bank, categorizes bank entries, and validates suggested entries so your books are done quickly and accurately. UTRGV’s MBA with a specialization in accounting program offers students MBA accounting and MBA foundation courses. Whether you want to become a certified public accountant or work in business accounting or auditing, the M. Prerequisite: TAX 610 or equivalent. Instead of struggling with bookkeeping and accounting software, you may find it’s more time and cost effective to outsource these tasks to a dedicated small business accountant. 65 may also provide insight about the reasonableness of judgments and assumptions supporting management estimates. Get in touch with customer support here. For those who have completed their undergraduate coursework at an institution besides Wisconsin, the university also offers an MBA program with a specialization in applied security analysis. Each school will also have minimum requirements based on standardized test ACT or SAT scores, high school grade point average, and the overall strength of the college application including the statement of purpose and letters of recommendation. If you can’t find a solution that offers you all the features you want, head over to our comparison of the best paid accounting software. These costs are generally capital expenses. And, like QuickBooks Online, FreshBooks includes built in mileage tracking—a must for freelancers who plan to claim mileage expenses on their year end tax forms. Chief financial officers. Most schools will want an undergraduate GPA of at least 3. Do you provide customer support. And you need software with a few more features like inventory or payroll, you can upgrade your account in just a few clicks. If you’re looking for effective, free accounting software, check out Wave Financial. Learn more about what that means for your program on our licensure and certification disclosure page. Wave has over two million users, making it a popular free service among sole traders, freelancers and small firms.

Contact Information

Henry carries the cash receipts total shown in the annual summary $47,440. Kim “The impact of performance measure discriminability on rate incentives” The Accounting Review 2010. © 2023 Florida International University Website by Digital Communications Website Feedback Web/Accessibility Sitemap. ARTICLE NAVIGATION: What is an Online Accounting Certificate. Suppliers frequently serve a single national market, while larger suppliers offer separate solutions in each national market. Accounting electives may be any 5000‐level ACG or TAX course except ACG 5026. Prerequisite: TAX 603/TAX 635/TAX 655/equivalent. IPhone and iPad apps are pretty handy for scanning receipts and tracking expenses. Admission to the MAcc can occur through application to the traditional MAcc or the 3/2 MAcc program. You’ll meet business and government leaders, participate in seminars, meet professors and accounting students from other universities, and visit local and/or multi national accounting firms. Accounting software is an essential ingredient for a successful business. For instance, FreshBooks can be configured to automatically reconcile credit and debit amounts and can automatically import financial data from a range of sources. They are driven by facts and might prefer questions with a right or wrong answer to more subjective topics. Schindler Memorial and Lake Charles Society of LA CPA scholarships. 60 for credit card transactions and 1% for each bank transaction + $1 minimum fee. Four Specializations. It can be online/long distance or on campus. FreshBooks’ more advanced payment features will also incur a fee of £15 per month. ZarMoney is an all in one solution with an impressive list of features. The program focuses on the knowledge of the U. What Are the Types of Accounting Software. It should allow you to create professional invoices, manage expense tracking, run double entry accounting reports, accept online payments, and monitor all parts of your business’s money – both in and out. Price: Free for businesses generating less than $50,000 per year in revenue; paid plans start at $15/month. However if you opt for a free accounting software for your small business, you’ll likely be missing out on a few things that other accounting software options offer. Upon acceptance into BLDP, students will be emailed their acceptance letter plus a special permission number allowing registration for the BLDP seminar. The tax applies to vehicles having a taxable gross weight of 55,000 pounds or more. The remaining 20% covers business management topics. Unless you are willing to shell out $10 $20 a month, you are limited to only five unbranded invoices per month. For one solution that’s most comparable to the accounting software options on our list, you may consider Bench. For the features and services you get, the price is a bargain.

EARN OVER $75,000 PER YEAR

Ditching spreadsheets for business accounting software can help you organize your financial documents and statements, reduce headaches during tax season, and remove unnecessary manual work. To many students, the BS in Accountancy at the University of Illinois is the best degree in accounting. It errs on the more expensive side of the tools on this list, but it has an impressive enough suite of features to back its prices up. The price depends on the school’s prestige and the delivery format. A minor in accounting is 18 hours 6 accounting classes, and a major in accounting requires 36 hours of accounting plus additional hours in business and general education. If you’re looking for a cheaper solution, Kashoo offers an invoice centric plan for $0. More program informationEmail: Phone: 203 254 4100. You’ll often need at least a mid tier plan to support multiple users. Accountants do, and they’ll thank you for it. Critical thinking: Identify trends and irregularities in spreadsheets and financial statements, and develop strategies based on the data. It’s the best accounting platform for a small company that’s just starting out and has few expenses to spare. For more information, see IRS. Digital materials give you immediate access to study materials, which Accounting Certificate students retain until passing the CPA Part 1 exam.

Benefits of FreshBooks Double Entry Accounting for Your Small Business

Like Zoho Books, Kashoo’s automation is its selling point—and unlike Zoho Books, it syncs with SurePayroll, one of our top payroll providers. ACG 5635 Auditing Theory and Application II 3 hrs. Featured or trusted partner programs and all school search, finder, or match results are for schools that compensate us. Whether you get your accounting degree online or go the more traditional route by seeking an on campus degree is a personal choice. The best applications suggest potential matches as you reconcile your accounts, and a few include a reconciliation tool in their mobile apps. Students can pursue an undergraduate degree with an accounting concentration, as well as a Master of Professional Accounting. On that date, Boeing’s Form 10 Q reflected consolidated shareholders’ equity of $7. Each semester, the School will post on its website a list of graduate courses that are available for the forthcoming semester that will satisfy the approved elective requirements. Once you know how much money you have budgeted, try not to spend too much time evaluating software that’s outside the realm of possibility. Save my name, email, and website in this browser for the next time I comment. The foundation courses are. $65,001 $75,000 median salary for recent business graduate students after earning their degree. We recommend Melio for small businesses seeking user friendly accounts payable tools that do not need a lot of bells and whistles. An up to date schedule of tuition and fees for in and out of state students can be found at OneStop. It has a free plan that provides basic invoicing, vendor and client management and digital payment processing through PayPal or Square. The entire program is STEM designated and prepares you for today’s CPA exam and the updated CPA exam coming in 2024, as well as CIA, CMA and CISA certifications. One thing is clear: without software, we’d be lost. Every accounting solution guesses how at least some transactions should be categorized. It will become compulsory for businesses when paying income tax from April 2026. The camp you fall into will dictate how much you pay for accounting software. Sunrise offers a mobile application for iOS and Android devices. Please note: Graduates of the Certificate in Advanced Accounting are not eligible for the Diploma in Accounting. Public universities, the Fisher School is ranked as the No. Chapel Hill, North Carolina. The following is the entry to reflect the responsibility for accounts payable. This information was sourced from verified user reviews of Itemize. University of Iowa Tippie College of Business47 tie. This compensation does not influence our school rankings, resource guides, or other editorially independent information published on this site. Sage enables a small business to spend less time on administrative tasks with invoicing, automatic expense tracking, and tax calculations. Start youronline businesstoday.

Be honest about your budget

Do I have to major in something else to get the certificate. The small size of the program ensures extensive faculty and student interaction. UVA McIntire School of Commerce. Shopify app or integration: Yes; third party integrations available. Customer review: “It’s easy to use. Small Business Trends is an award winning online publication for small business owners, entrepreneurs and the people who interact with them. Say goodbye to manual stock take and automate your inventory management process. Required Education: Bachelor’s degree in accounting, master’s degree and certification often preferred. The graduate school of management offers an online and on campus master of business administration MBA. For a full list of Florida State University funding and awards, visit gradschool. Get recruited by all of the top firms and major corporations WHILE you’re in school. Revenue restrictions apply. With a subscription pricing model, you pay a monthly or annual fee for access to the software. Chamber of Commerce 1615 H Street, NW Washington, DC 20062. Knowledge Integration. Gov/Notices to find additional information about responding to an IRS notice or letter. Accordingly, the requirement for responding to significant risks also applies to fraud risks. Through the years, the fraternity has grown to include finance and information systems students. We recommend you work on and submit your complete application well in advance of the preferred deadline, as obtaining transcripts and other materials may take more time. Information for accessing the applicant portal will be provided after submitting an online application for admission. However, its three plans are designed for growing businesses, letting you upgrade as your business expands. A master’s in accounting is an especially good option for students who want to pursue the certified public accountant CPA designation. It provided the required training, offered flexibility in my learning path, and created a perfect platform to complete my degree and assisted me in obtaining one of the most esteemed accounting designations – Chartered Accountant CA. Colleges and Departments. IU’s Kelley School of Business offers a one year Master of Science in accounting with data and analytics, a combination of courses and experiential learning.

Best for Deadline Driven Businesses

Rising inflation in 2022 added to financial woes. Why we chose it: Users report that Neat is easy to use, freeing up time spent on bookkeeping — time you can use to generate more revenue — making it our top pick for best accounting software for freelancers. Yet CPAs comply with extra educational and work requirements to receive their license. Insider has published a first hand account from a 37 year old who lost their job at the beginning of the pandemic when the accounting firm they were working for went under side. Here are some tips for a small business owner on how to choose accounting software for your small business. Erika Durning, Managererika. 2404 Maile Way, Honolulu, HI 96822 United States of America. 22 Furthermore, additional testing of count sheets, tags, or other records, or the retention of copies of these records, may be warranted to minimize the risk of subsequent alteration or inappropriate compilation. Zoho Books meets all your basic needs: send invoices, reconcile accounts, track expenses and generate reports. There are typically two types of pricing models for accounting software: perpetual licensing or a recurring subscription. This course is designed to familiarize students with the IFRS in the global practice through the study of advanced accounting topics on financial statement elements and presentation, first time adoption of IFRS, and IFRS for Small and Medium Sized Entities IFRS for SMEs. By the end of this course, students will be proficient in analyzingfinancial statements, including understanding a company’s strengthsand weaknesses, as well as whether a company presents a goodinvestment opportunity. These include accounting, economics, statistics, management and marketing. The functionality of accounting software differs from product to product. At the end of the day, it may be difficult to meet your budget exactly, but you’ll want to have a price range in mind as you go through the search process to find the best accounting software for your small business. NerdWallet Compare, Inc. The best accounting software integrates with other key business systems like payroll software and HR software, eliminating the need to enter the same data manually in multiple systems. In both cases, you can make either task much easier by enlisting the help of bookkeeping and account software. Arizona State University’s Bachelor of Science in accountancy is ranked among the best programs in the nation by U. Why did you choose to study accounting. With a nearly 100% graduate employment rate, the graduate program at Arizona State puts students in a great position to start their careers. Learn more about our application requirements and how to submit a strong application.

Educational Foundation for Women in Accounting Scholarships

Before you can register for classes you will need to submit documentation or complete an assessment test. The online MBA program was ranked in the top 30 by The Princeton Review in 2021. Reddit and its partners use cookies and similar technologies to provide you with a better experience. 30 for Visa, Mastercard, and Discover and 3. Once you enroll in the accounting program, you can select an area of focus from the following options. You can get in touch with the support using the AI powered chat or fill out the contact form. Your academic advisors, library services, the career center, military student services, and other support systems are never more than a click or a call away. Indeed, 47% of respondents to a QuickBooks survey indicated that they wanted to automate running financial reports. Our comprehensive curriculum and diverse requirements will challenge you to go further than you ever imagined. The following ranked list profiles the top five graduate accounting programs of 2023. We rate these applications primarily based on how easy they are to use, how much they do, and their price. Plus, Zoho’s full fledged accounting software, Zoho Books, has a free plan for businesses that earn less than $50K USD per year. Further, most software solutions store the information in the cloud, so your data will be secure and safe if your computer crashes or you experience other technical issues. For more information on the AMIS graduate programs, please see the Graduate Studies Committee Handbook below. The requirements for the proposal defense should be discussed with the dissertation committee prior to scheduling the defense. University of Illinois at Urbana Champaign: 10. Zoho Book’s list of features is long and may provide more functionality than your small business might need. Prelim Readings GEB 6904Prelim Exam ACG 8964Finalize 2nd Year Paper. Depending on where you do business, you’ll pay a monthly base fee of either $35 or $20, plus $4 per employee and contractor on your payroll. The coursework completed in a graduate certificate program provides a solid foundation in a particular area of study. This ensures that your books are correct and that you can withstand a financial audit. Free trial length: 30 days. Wave makes money through our optional, paid money management features include online payment processing, payroll software, and access to personalized bookkeeping services and coaching through Wave Advisors. Balancing school with work and family life can be challenging. Standard Students select a pre set weekly schedule of courses that best meets their needs in person, hybrid and online.

Undergraduate Programs

Offers and availability may vary by location and are subject to change. There’s no charge to make payments through a bank transfer, but there is a 2. RCC also offers related certificates in accounting/bookkeeping, payroll accountant specialist, and tax preparer. Having both the payroll and accounting software for the same price I was paying for just payroll services through another provider made it a very easy decision to switch. Track project expenses, costs, GST, VAT, sales tax. The students will be responsible for registering and completing the General Education courses on their own. The accounting field is projected to add an additional 166,700 jobs by 2022, according to the U. Below are our helpful guides to finding the right bookkeeping software tailored to specific features or areas of accounting. The university is ranked as a Public Ivy and that speaks to the quality of the Kelley School accounting program. As a small business owner, all you may want your accounting software to do is help you manage your receipts and expenses. Payroll, an often needed service, also isn’t included in the free service either and runs $40 per month, with an additional $6 per active employee or an independent contractor, and furthermore, you do get the occasional advertisement – just as you do with pretty much any free online service. For subscription pricing, expect to pay anywhere from $8. Free English French English support French support Data stored in Canada iOS app. But if you’re looking for a one stop, comprehensive solution for virtually all your business needs — accounting included — this could be the platform for you. The cloud version, on the other hand, hosts your data on servers located in the United States. Students complete a core of 5 required courses 15 credits, two additional accounting courses 6 credits, and then complete three courses 9 credits from business courses outside of accounting. News and World Report. Students should discuss any previous college experience and earned credit with their admission counselor. Frequently Asked Questions. You will receive money or property from many sources. Read our in depth comparison of QuickBooks Online vs Desktop to choose the best software for your business.

AT A GLANCE

The 14 course curriculum includes classes on. Some courses are also offered online. ERP software is typically used by larger businesses while accounting software is more suited for small businesses. Some can only capture receipts for expense tracking, some allow you to create and send invoices, and others have almost every feature the web based software does. Additionally, the workshops foster collaboration between students and faculty, by providing opportunities for joint research, publication and professional development. You will have full access to Business Career Services resources, helping you gain the knowledge and professional skills to be even more competitive in today’s challenging job market. However, with the basic functionality of their web based products, these particular small business accounting software options are probably best suited for very small businesses and sole proprietors. Our helpful admissions advisors can help you choose an academic program to fit your career goals, estimate your transfer credits, and develop a plan for your education costs that fits your budget. Students with a bachelor’s degree in accounting will have satisfied all or most of the foundation course requirements through their prior studies. Median Annual Salary: $98,980. Insurance accounting is based on regulatory requirements Statutory Accounting Principles or SAP, as well as standards applicable to insurers based on the jurisdiction in which the insurer is organized. Support from real accountants we’re a simple, affordable upgrade away. Freelancers can sign up for the basic Self Assessment package that helps you track your self employed income, while small businesses can use it for things like VAT and payroll. Here are some trends to watch going forward. Students planning to obtain their CPA are responsible for ensuring that they meet their state’s requirements for exam and licensure.